et stock dividend increase

Stock Research Trading Tools Designed for New Experienced Traders. ET declared a quarterly dividend of 0175 per share or 07 annualized.

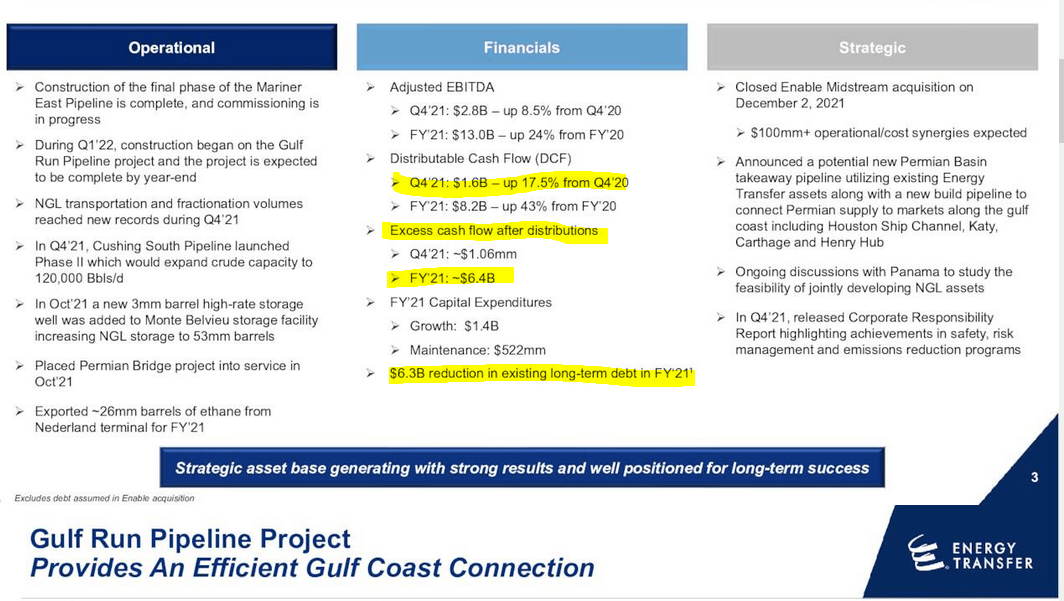

This 6 7 Yielding Dividend Stock Took Another Step Towards Delivering On A Big Promise The Motley Fool

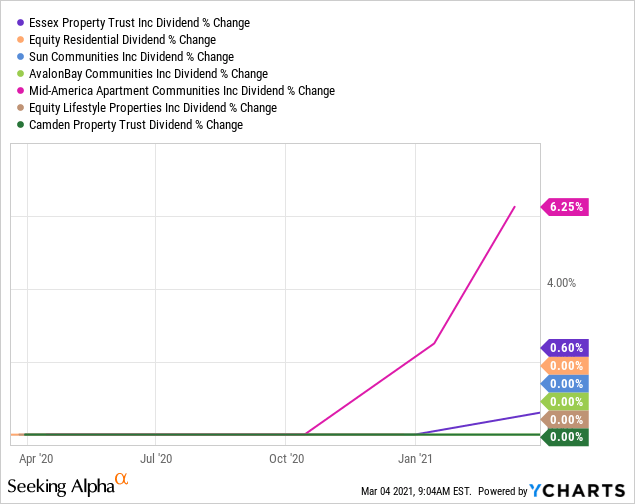

I own the highlighted stocks in my DivGro portfolio.

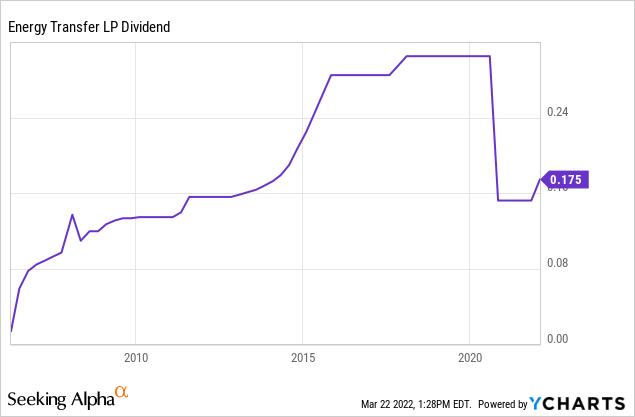

. The dividend payout ratio of Energy Transfer is 7547. Given their dividend growth history the stocks may deliver annualized. 3 5 10 year growth rate CAGR and dividend growth rate.

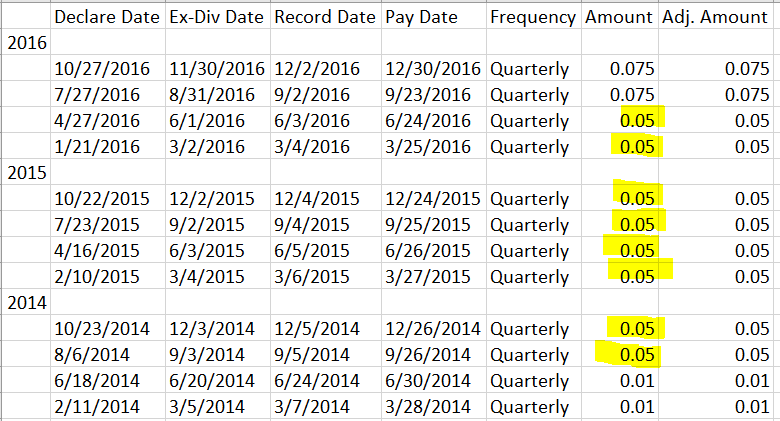

Energy Transfer does not yet have a strong track record of dividend growth. 22 2021 DIVIDEND ANNOUNCEMENT. View ETs dividend history dividend yield next payment date and payout ratio at MarketBeat.

For shareholders of record Feb. In terms of opportunity ETs provides a return of 59029 based on the forecast of the dividend discount model we used relative to its current share price. Get the latest Energy Transfer LP ET stock news and headlines to help you in your trading and investing decisions.

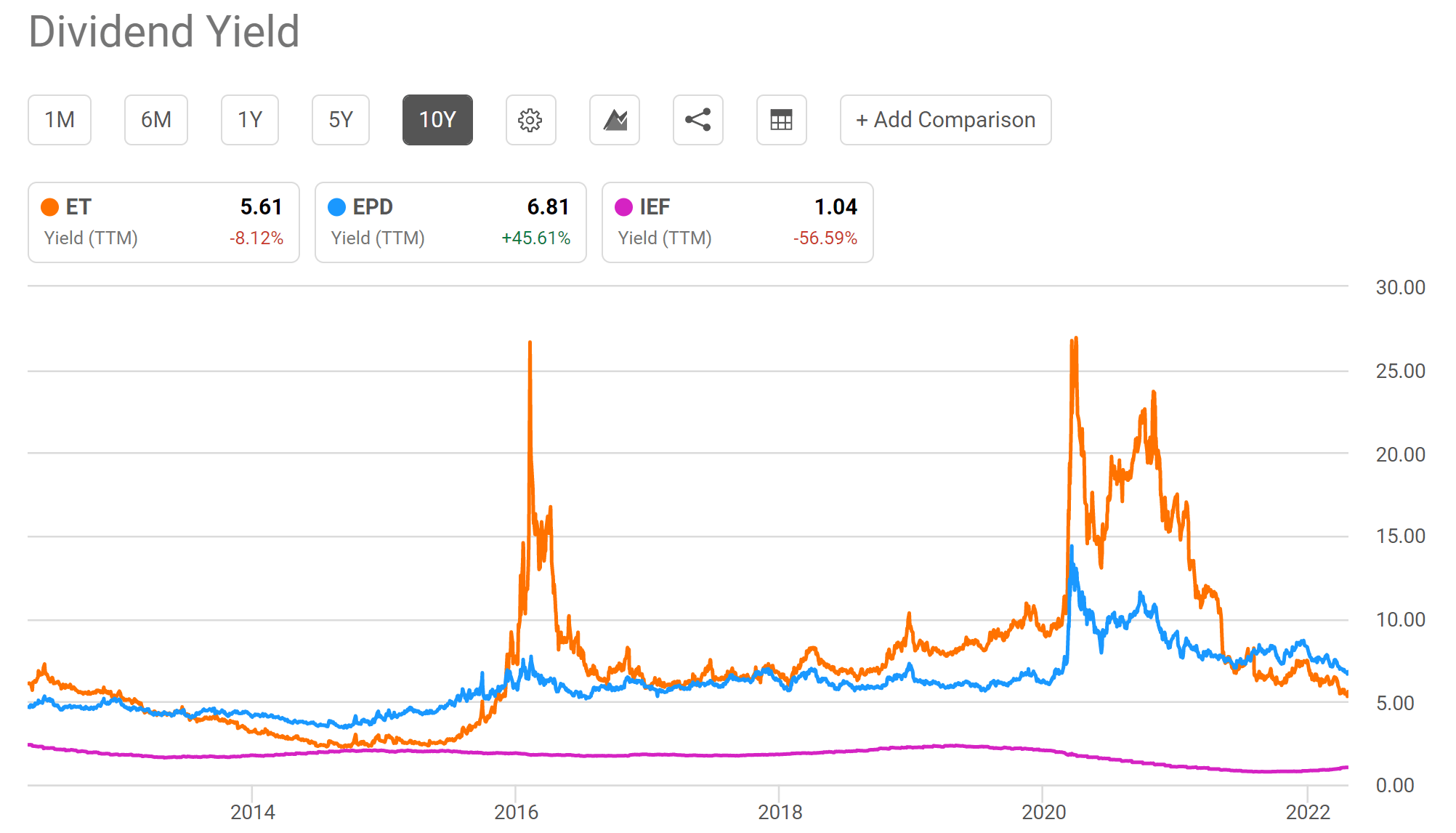

I explain the differences between growth stocks and dividend stocks. Energy Transfer LP ET dividend growth summary. Is Energy Transfer NYSEET a good stock for dividend investors.

Ad 0 Commissions Online Specialized Trade Platforms Satisfaction Guarantee. And during the September quarter the. 1 year growth rate TTM.

Here are my top 7 DG stock picks for 2022. ENERGY TRANSFER shareholders who own ET stock before this date received ENERGY TRANSFERs last dividend payment of 02000 per share on 2022-05-19. Energy Transfer LP ET Dividend Data.

Energy Transfer is a holding company. Energy Transfer NYSE. ENERGY TRANSFERs next ex-dividend date has not been announced yet.

I understand why investors may be interested in buying shares of Energy Transfer NYSE. ET has a dividend yield higher than 75 of all dividend-paying stocks making it a leading dividend payer. This company has rewarded investors with multiple dividend increases since 2019 including a 178 dividend bump in 2021.

This is a better return than 8725 of all stocks we. For example Robinhood s most popular dividend growth stocks. Below I provide a table.

Is engaged in natural gas operations including natural gas midstream and intrastate transportation and storage. In todays video I explain and categorize stocks into buckets. ENERGY TRANSFERs previous ex-dividend date was on 2022-05-06.

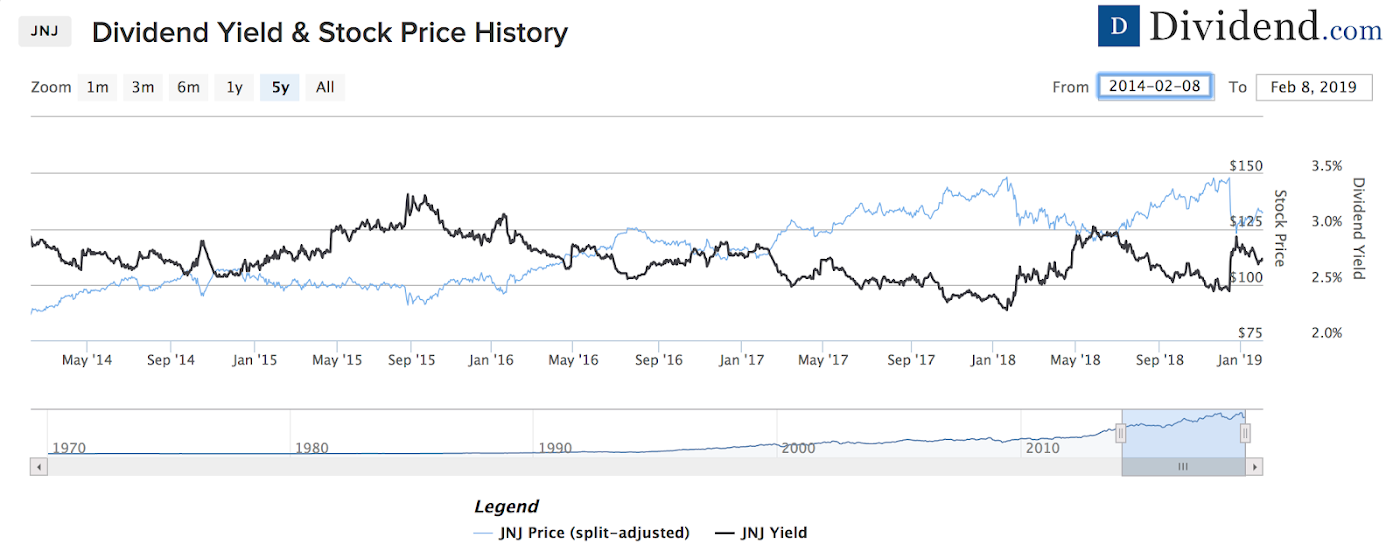

26 2022 DIVIDEND RATE INCREASE. 641 Typical ex-date schedule. For illustration of dividend stocks potential I will focus on the SPDR SP Dividend ETF SDY 114 which invests in stocks that have consistently increased their.

Add ET to your watchlist to be reminded before. This pipeline company has a 72 yield paid for the. The result was a median increase in the SP 500 dividend during the June quarter to 83 up from 77 in the March quarter and 48 in the December quarter.

Interstate natural gas transportation and storage. This is a 148 increase from the prior dividend of. A loss of 32 cents per share missed analysts expectations by 66 cents as the consensus expected a profit not a.

ETIn a volatile market ET stock has an eye-popping dividend yield of 1473 as I. This printer company has a 27 dividend yield and a forward PE of 82 times with a 167 FCF yield. Review the current Energy Transfer LP ETXNYS dividend yield and history to decide if ATUS stock is the best investment for you.

Valuing ET Stock. ET Dividend History Description Energy Transfer LP. And crude oil natural gas liquid NGL and refined products transportation.

Through its subsidiaries Co. This 69-Yielding Dividend Has Explosive Growth Potential. At the current stock price of 983 the dividend yield is 623.

Payout Ratio FWD Fwd Payout Ratio is used to examine if a companys earnings can support the current dividend payment amount. Log In Help Join. The most recent change in Energy Transfers dividend was an increase of 00250 on Tuesday April 26 2022.

On Monday May 11th ET stock reported earnings after the close. It divides the Forward Annualized Dividend by FY1 EPS. Energy Transfer NYSEET declares 0175share quarterly dividend 148 increase from prior dividend of 01525.

Energy Transfer LP ET. These Dividend Radar stocks are discounted and yield at least 3. Forward Dividend Yield.

What is Energy Transfers dividend payout ratio. Energy Transfer pays an annual dividend of 080 per share and currently has a dividend yield of 691. Best dividend capture stocks in May.

Forward yield 753 Payable Feb. The previous trading days last sale of ET was 983 representing a -1489 decrease from the 52 week high of 1155 and a 9275. Do you know the 11 highest-paying dividend stocks in each sector of the market.

Real time Energy Transfer LP ET stock price quote stock graph news analysis. Relative to all dividend yielding stocks in our set Energy Transfer LPs dividend yield of 694 is in the top 834999999999999.

Beyond Dividend Aristocrats Here Are 3 Great Income Stocks That Nobody Is Talking About The Motley Fool

Energy Transfer Vs Enterprise Products Better Dividend Stock Seeking Alpha

Energy Transfer Stock Attractive With Dividend Raises Coming Seeking Alpha

Et Dividend History Ex Date Yield For Energy Transfer Lp

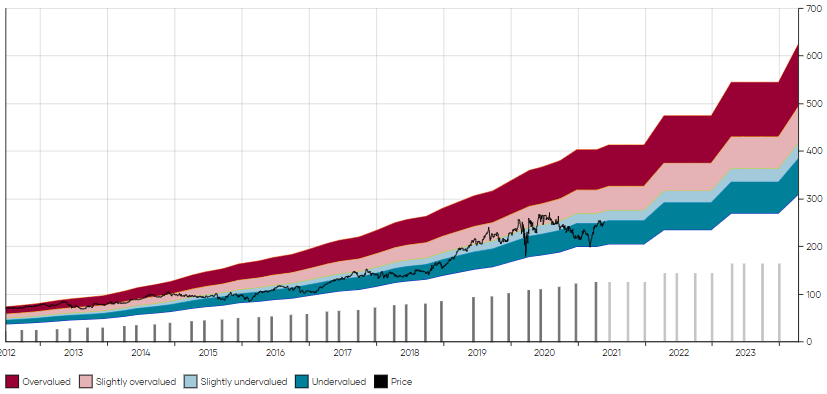

Using Average Dividend Yield For Dividend Growth Stock Valuation Seeking Alpha

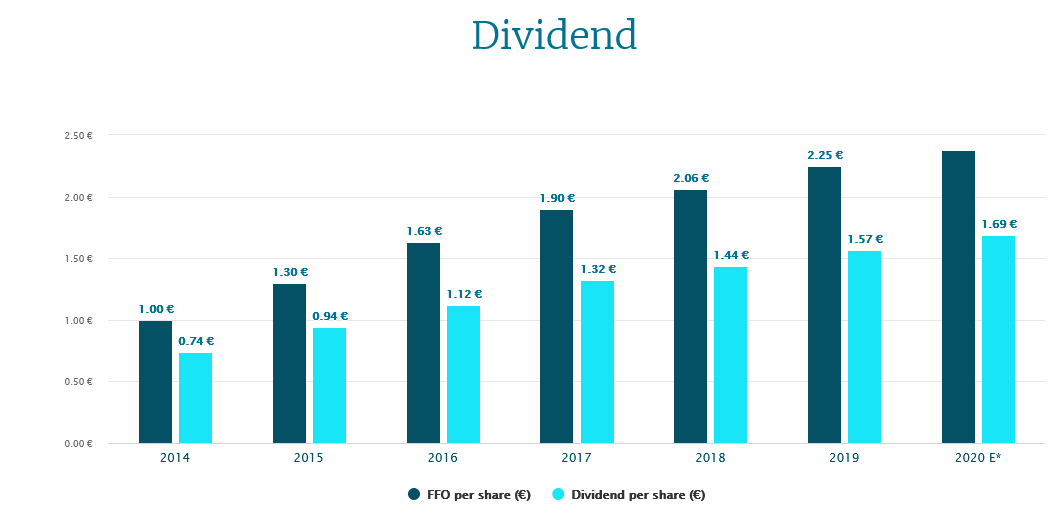

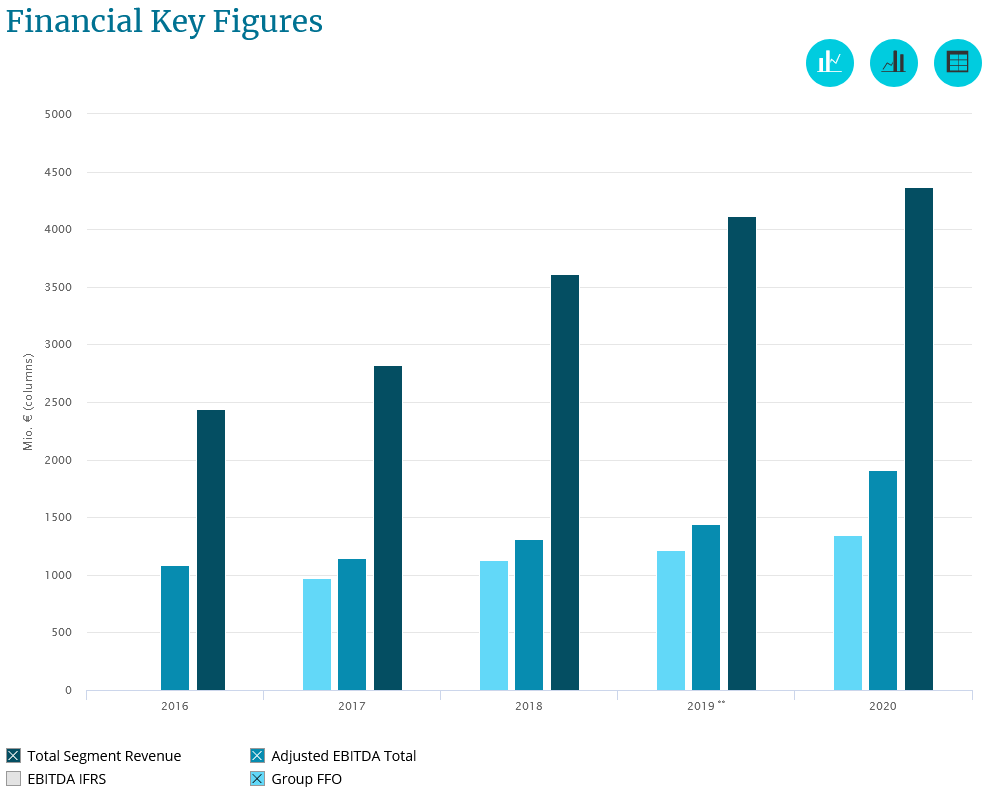

Vonovia Is A Dividend Growth Stock You Can Bank On That Trades Below Fair Value Vnnvf Seeking Alpha

Vonovia Is A Dividend Growth Stock You Can Bank On That Trades Below Fair Value Vnnvf Seeking Alpha

Vonovia Is A Dividend Growth Stock You Can Bank On That Trades Below Fair Value Vnnvf Seeking Alpha

Seeking At Least 6 Dividend Yield Morgan Stanley Suggests 2 Dividend Stocks To Buy

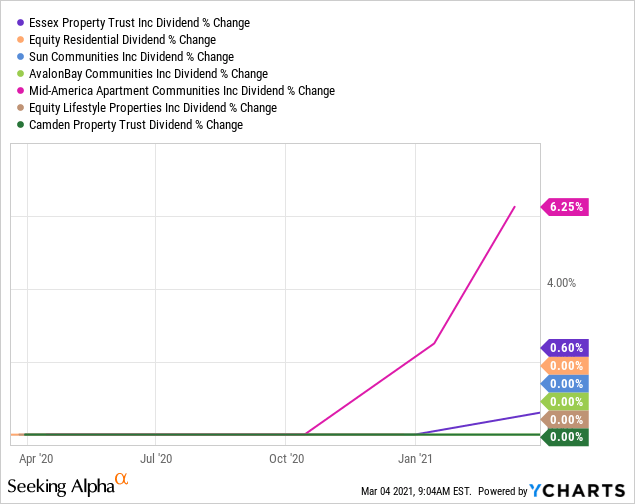

My Top 16 Dividend Growth Stock Picks For 2022 Seeking Alpha

Retail Investor Org Predicting Growth Investor Education

21 Upcoming Dividend Increases Including One Dividend King Seeking Alpha

Retail Investor Org Predicting Growth Investor Education

Energy Transfer Stock Attractive With Dividend Raises Coming Seeking Alpha

Energy Transfer Stock Attractive With Dividend Raises Coming Seeking Alpha

Buy These 4 Dividend Growth Stocks To Become Inflation Proof Seeking Alpha

This 7 3 Yielding Dividend Stock S Growth Streak Seems Unstoppable The Motley Fool